Question 256 of 258 from exam MLS-C01: AWS Certified Machine Learning - Specialty

Question

You work as a machine learning specialist for a software company that produces an auction website where users can buy art work through an auction process.

Your task as a machine learning specialist for the company is to produce a machine learning model that estimates the value of the various art products put up for auction.

You have decided to use a deep learning model to produce your estimates.

Your data source has many features, such as artist, artist selling history, category, category selling history, rarity of product, etc.

Some of these features have outliers.

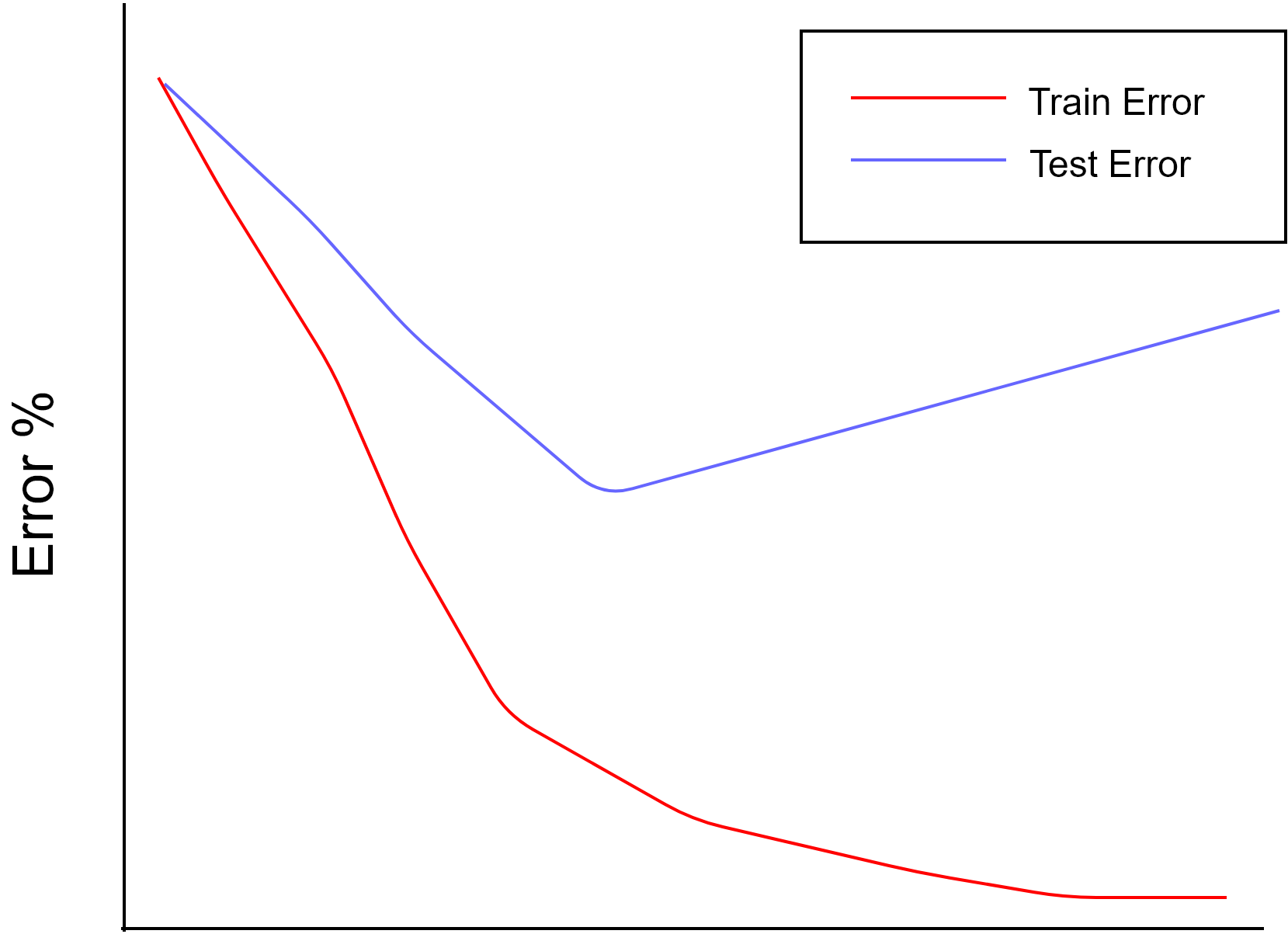

In your training you have realized that you have an overfitting problem.

You have graphed your training error and testing error: You need to address your model overfitting.

You have decided to use regularization to address your overfitting problem.

Which regularization technique best fits your situation?

Answers

Explanations

Click on the arrows to vote for the correct answer

A. B. C. D.Correct Answer: A.

Option A is correct.

Lasso regularization (L1) is the best choice here because you have outliers in your feature data.

L1 regularization handles outliers well.

Option B is incorrect.

Ridge regularization (L2) does not handle outliers as well as L1 regularization.

Option C is incorrect.

Using dropout with outliers is more effort than using L1.

Option D is incorrect.

Early stopping will not address your outlier problem.

Reference:

Please see the Neptune blog titled Fighting Overfitting with L1 or L2 Regularization - Which One Is Better? (https://neptune.ai/blog/fighting-overfitting-with-l1-or-l2-regularization), and the Machine Learning Mastery article titled How to Avoid Overfitting in Deep Learning Neural Networks (https://machinelearningmastery.com/introduction-to-regularization-to-reduce-overfitting-and-improve-generalization-error/), the Data Driven Investor article titled L1 and L2 Regularization (https://medium.datadriveninvestor.com/l1-l2-regularization-7f1b4fe948f2)